Table of Contents

What Is The Office Of The Comptroller Of The Currency (OCC)?

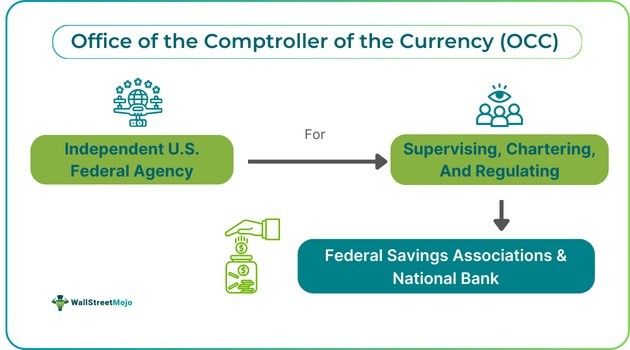

The Office of the Comptroller of the Currency (OCC) refers to the autonomous federal agency of the U.S. government obligated to oversee Federal Savings Associations and National Banks. It serves to make sure that all financial institutions remain unharmed, offering open access related to financial services and enforcing applicable regulations and laws.

It has staff consisting of examiners conducting onsite reviews pertaining national banks and infinitely supervise operations of banks. OCC can formulate rules and draw inferences on investments, lending activities and management of banking operations. It can expel bank directors, deny setting new branches and punish banks.

Key Takeaways

- The Office of the Comptroller of the Currency (OCC) represents an independent U.S.

- Federal agency having responsibility concerning overseeing Federal Savings Associations and National Banks, ascertaining financial stability, regulatory adherence, and fair access to services by consumers.

- It was established in 1863 by President Lincoln and received authority through the National Banking Act.

- It has headquarters in Washington, D.C., having offices in 51 U.S. cities, employing 3,472 staff mostly bank examiners, supervising regional risk management, regulations banking, and compliance.

- OCC regulates and charters banks, supports consumer protection and fair access, approves applications, enforces laws, issues rules, and oversees compliance and financial inclusion.

Office Of The Comptroller Of The Currency Explained

The Office of the Comptroller of the Currency (OCC) represents the autonomous bureau under the U.S. Department Of Treasury that supervises charters. It regulates associations of federally charted savings, foreign banks' federal branches and national banks. It came into existence through the 1863 National Currency Act to establish a stable and robust banking system. All banks being supervised by OCC provide funds to it and must give processing and examination fees. Its head, called the Comptroller, is appointed by the U.S. president.

Its examiners assess the soundness and safety of banks by evaluating practices of risk management, overall financial health and adherence to regulations. OCC has been playing a crucial role in sustaining public trust and confidence in the banking system. It has prepared such a regulatory framework that it promotes responsible banking innovation while also protecting its customers against unfair practices and fraud.

All U.S. banks depend on the framework of OCC regarding adherence to federal banking regulations. OCC issues interpretations and rules to help banks navigate the sophisticated regulatory environments. OCC has a dominating role in the financial sector as it prepares the necessary framework for banks to work in a healthy business environment, keeping the faith of consumers intact and high.

As a result, it has sowed the seed of economic growth and stability. In other words, one can say that OCC is crucial for consumer safety, stable financial systems and regulation of national banks.

History

OCC’s history goes back to the eighteenth century and has the following chronology:

- It was set up on 25 February 1863 by the then American President Abraham Lincoln with the office of the Comptroller of the currency address as 400 7th St. SW Washington, DC 20219.

- It had the role of administering a procedure of nationally chartered banks.

- It had its authority revised through the formulation of the National Banking Act of 1864, allowing it to employ national bank examiners and staff to manage the banking companies. Besides, it also obtained the authority to regulate nationalized banks' investment and lending activities.

- The Home Owners Loan Act expanded its scope of regulation in 1933.

- Later on, it received the powers of oversight of federal savings associations through the enactment of the Dodd-Frank Act in 2010.

Structure

OCC’s structure has the following elements:

- It has headquarters in Washington, D.C., having offices in 51 cities across the United States. The office of the Comptroller of the Currency phone number is (202) 649-6800.

- It has a comptroller as its executive management appointed, and the president has a 5-year term.

- It has almost 3472 individuals working as employees, mostly bank examiners.

- It has created four district offices to manage the regional banking activities.

- Its staff members offer supervision of banks using analysis of investment portfolios, bank loans, capital, funds management, and sensitivity about market risks and liquidity.

- Examiners also review internal compliance and control having applicable laws and regulations while evaluating the ability of management to control and identify risks.

Role And Power

OCC has huge power and a crucial role in the banking industry, so it has vital roles and power as listed below:

- Regulates and charters federal savings associations and national banks.

- It can deny or approve applications of banks related to new branches or charters.

- It has the power to take enforcement actions towards non-compliant banks.

- It has a critical role in issuing laws governing the practices of banking.

- Office Of The Comptroller Of The Currency enforcement actions include the ability to terminate services of directors and officers of banks.

- Under the National Banking Act stipulations, it can circulate regulations and rules controlling lending, miscellaneous banking practices and investments.

- Furthermore, OCC must give guidance in written form to the banking industry in the shape of interpretive releases, bulletins and banking circulars.

- In some instances, it can also publish cease-and-desist orders.

- It can also negotiate contracts with banks to modify any bank's practice.

- If any bank has violated its charter, then OCC can punish it monetarily also.

- After the Dodd-Franck Act issuance, the OCC was responsible for continuous supervision, regulation and examination of federal savings associations.

- It also issued a final rule regarding executions of many provisions of the Dodd-Frank Act, like alterations to enable the transfer of the functioning from the Thrift Supervision Office.

- It ensures equal treatment and fair access to bank account holders.

- It also helps in the financial inclusion of the poor, making banks leaders in holistic and protective community development.

- OCC enforces banks to adhere to laws of consumer banking.

- It runs a website- called Help With My Bank to help bank customers with their common queries and allow them to file grievances and the office of the Comptroller of the currency complaints against federal savings associations or national banks.

Who Is Regulated By The OCC?

Being government government-autonomous regulating body, it regulates the following:

- More than 1000 National Banks throughout the United States

- Monitors and supervises federally chartered savings associations with a national charter falling inside the Owners Loan Act and National Bank Act.

- Supervises agencies of foreign banks and federal branches functioning in the United States.

- It also evaluates 3rd party service providers concerning banking operations.

- It has the power to accept or reject the proposal of modification to structure or changes by chartered banks.

- It also assesses the submissions to ensure corporate structures of banks have been maintained and set up as per the principles of a robust and safe banking system.